Author: Matthew Klein, CFP, CSRIC, CRPC

We have been asked by several of our clients to evaluate the impact their current bank is having on various ESG issues, especially when it comes to the environment. One topic that often comes up is the impact their bank is having on funding fossil fuel companies. The answer is pretty simple, if you bank with any major/national banking chain, they are likely using your deposits to make loans to fossil fuel companies

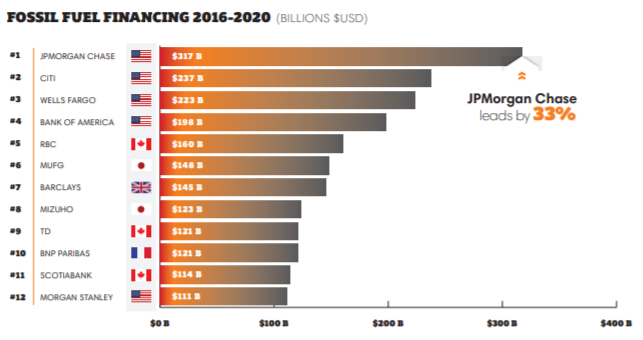

From 2016 – 2020, the top 5 financers of fossil fuel included the 4 largest American consumer banks.

1. JPMorgan Chase: $316.73 Billion

2. Citi: $237.47 Billion

3. Wells Fargo: $233.34 Billion

4. Bank of America: $198.45 Billion

5. RBC: $160.12 Billion

For the full list and a more in-depth report on their funding, view pages 7-8 of the Banking on Climate Chaos 2021

Report found here.

Going further down the list you will find several other major banks you may find in your neighborhood with TD coming in at #9, HSBC at #13, and Santander at #32. Refer to the link above to see where your bank ranks on the list.

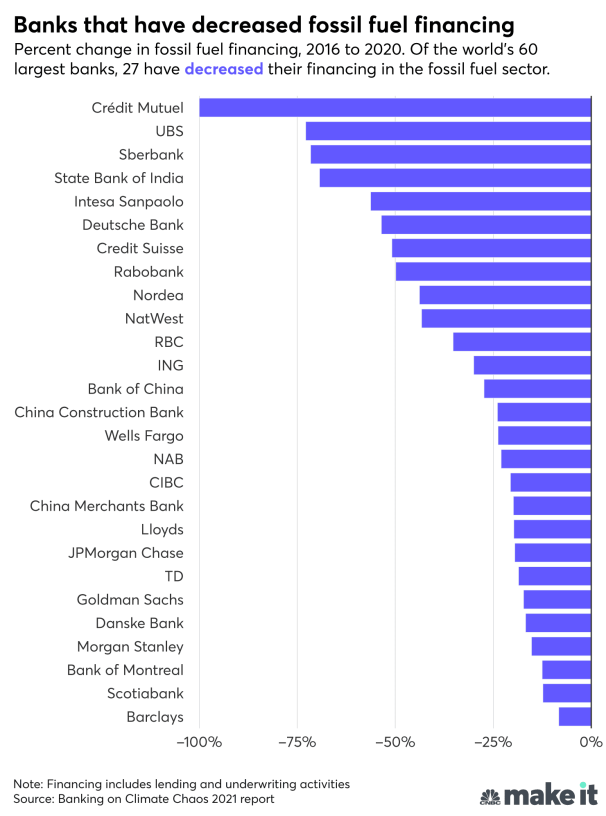

However, all of the above banks have been decreasing their fossil fuel financing over the past 5 years. Many banks have even made pledges to phase out fossil fuels completely. The image below depicts the banks that have decreased their fossil fuel financing the most in that time period.

The question then becomes, if essentially all major banks are providing some sort of funding for the fossil fuel industry, what are your options? Generally, the answer is to bank small and local. Examining your local credit unions is a great place to start. Their business model is different and they are not relying on fossil fuel lending to drive profits.

A great place to search for these ESG friendly local banks is by using Mighty Deposits to browse different banks. For a search that we have already populated for the NYC area, visit this link here. All searches already exclude banks that lend to fossil fuel companies.

It is important to keep in mind you may be giving up some things that you have become accustomed to with your current bank. These include robust mobile apps and better technology overall. You may also find higher lending rates at local banks as they do not have the same volume to keep rates lower. Lastly, they may not service everything you need such as providing auto, home, and personal lending all under the same roof.

On the other hand, banking small could improve your quality of service. Most importantly, you will have the benefit of knowing your bank is not furthering the expansion of the fossil fuel industry. If that is something that is important to you, it may be worth exploring your local options.